The Internal Revenue Service (IRS) just announced that the estate and gift tax exemption for 2020 is increasing to $11.58 million per person — up from $11.40 million in 2019.

If you are like most people, you are probably asking, “What does that actually mean?”

What is the Estate & Gift Tax Exemption?

As I explained in the summary of estate and gift taxes I wrote last year:

The estate tax is a federal tax imposed on estates over a certain value. That “certain value” is known as the “estate tax exemption” or “combined estate and gift tax exemption” or “unified credit” or a dozen other names.

The main thing to know is this: if an estate is worth more than the estate tax exemption amount, the value over the exemption will be taxed. If the estate is worth less than the exemption amount, no tax liability.

So the increase announced yesterday by the IRS means that if an estate is created (i.e., if a person dies) in 2020, there will be no estate tax imposed if the estate is worth less than $11.58 million. And thanks to estate tax portability, a married couple can now shield double that amount, $23.16 million, from estate taxes in 2020.

Keep in mind that, similar to income taxes, there are a variety of estate tax deductions that “decrease” the value of an estate for the purpose of determining estate tax liability. So people can effectively shield millions more by carefully planning their estates.

The IRS also confirmed that the annual gift tax exclusion amount for 2020 remains at $15,000 per individual per year, unchanged since 2018. This means you can give $15,000 to as many people you want (me, for instance) each year without filing a gift tax return.

How Do Estate Taxes Affect Me?

As far as problems go, being worried about estate taxes is a pretty good problem to have because it means you have a ton of money. It’s like Shakespeare once said, “Mo’ money, mo’ problems.”

In 2017, when the estate tax exemption was $5.49 million per person ($10.98 million per couple), only about 0.2% of estates had to pay estate taxes. That’s approximately 2 estates out of every 1,000.

However, the Trump Tax Cuts doubled the estate tax exemption to $11.18 million per person ($22.36 million per couple) in 2018. While there is not yet precise data, projections indicate that less than 0.1% (one-tenth of one percent) of estates will end up having to pay federal estate taxes under the Trump Tax Cuts.

That’s less than 1 estate out of every 1,000.

To put that in perspective, approximately 2.7 million people died in 2018 — but less than 2,000 estates had to pay taxes. The estate tax only affects the wealthiest of the wealthy. 99.9% of Americans do not currently need to worry about federal estate taxes.

But the key word is “currently.” Tax policy changes all the time. A number of 2020 presidential candidates have proposed reducing the estate tax exemption. Yet even the most aggressive of these plans proposes lowering the exemption only to $3.5 million per person ($7.0 million per couple). Even the Trump Tax Cuts are scheduled to have the exemption revert back to $5 million (adjusted for inflation) after 2025, if Congress does not change the law.

In any case, if your net worth is under $3.5 million, none of the estate tax proposals currently being discussed would affect you. You are safe for now.

What if I Do Have to Worry About Estate Taxes?

If your net worth is high enough that your estate might be subject to taxes after your death, you should consult an experienced estate planning attorney immediately.

There are a number of steps you can take to minimize eventual estate taxes, but they require careful planning.

Let me be clear: I am not talking about “hiding” assets or evading taxes. That kind of thing is what we in the law call “not cool” (i.e., illegal). Rather, estate tax planning is arranging the transfer of your wealth so that your children or other beneficiaries receive the most value possible from your estate.

So, if your estate is currently worth several million dollars or if you expect a windfall or large increase in the value of your estate in the coming years — perhaps you plan to sell a business, take a company public, or inherit millions of dollars from your parents — consider visiting an estate planning attorney to discuss what steps you can take to prepare for the future.

A word of warning. Many attorneys offer estate planning services. A simple will or a basic living trust can be prepared by people who do not necessarily focus their practice primarily on estate planning (though I believe there is often a dramatic difference in the quality of advice you get from those attorneys).

However, estate tax planning requires a high degree of knowledge and experience. If an attorney does not focus most of his or her practice on estate planning, I would be very wary of having them assist you with this kind of wealth transfer planning.

What Else is Changing?

In addition to increases to the estate and gift tax exemption and the annual gift tax exclusion, the IRS announced a number of changes taking effect in 2020 due to annual inflation adjustments.

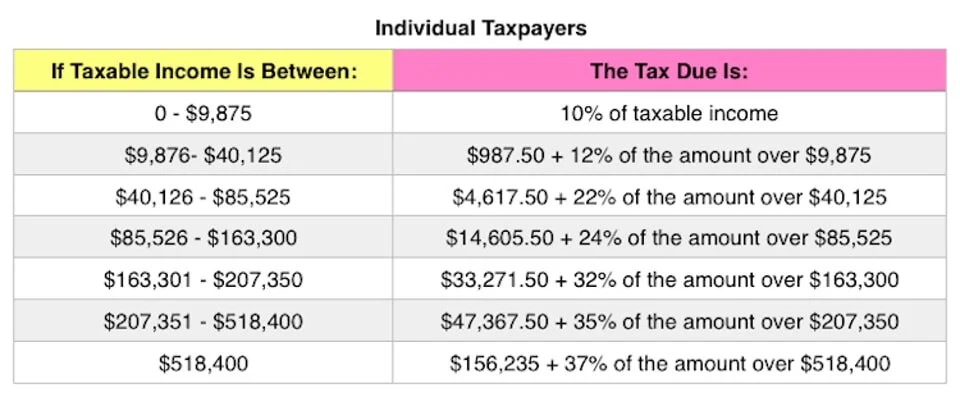

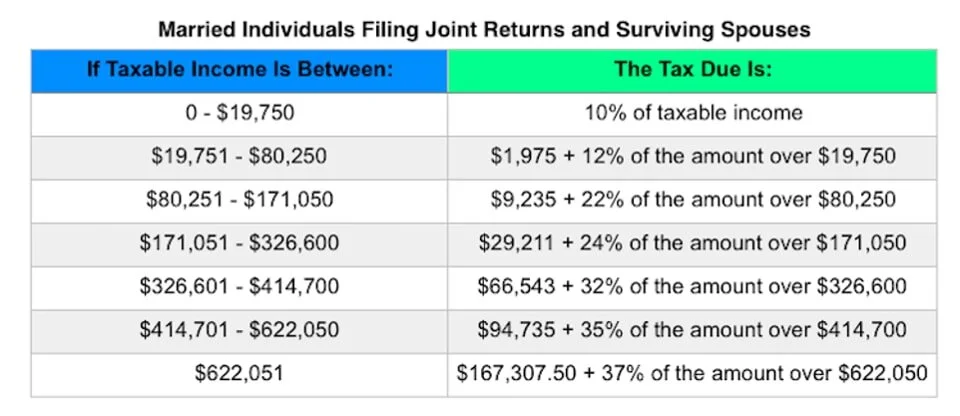

Most notably, the IRS announced tax brackets and tax rates for 2020. The charts below show the 2020 tax tables for individual taxpayers and for married couples filing jointly:

Forbes put together a great summary with additional tax tables and information about the 2020 standard deduction, capital gains rates, and other inflation-adjusted items.

You can also read more about higher retirement plan contribution limits for IRAs, 401(k)s, and more.

Minimize Taxes Through Estate Planning

The estate tax is a complicated and nuanced topic. Misunderstanding these concepts, or failing to adequately prepare for them, can have dire consequences for your beneficiaries. Do not settle for an attorney who does not have the knowledge and expertise necessary to protect you.

To learn how to maximize the wealth you leave to your loved ones, or to take other actions to preserve your hard-earned assets, contact the experienced Oklahoma City estate planning attorneys at Postic & Bates today for a free, no-obligation consultation.

David M. Postic is an attorney at Postic & Bates, P.C. His practice focuses on estate planning, probate, real estate, trust administration, business planning, and adoption.

You can email David through our Contact Us page or by calling our office at (405) 691-5080.

[As with all our blog posts and other publications and resources, the contents of this article do not constitute legal advice and are subject to our site-wide disclaimer.]